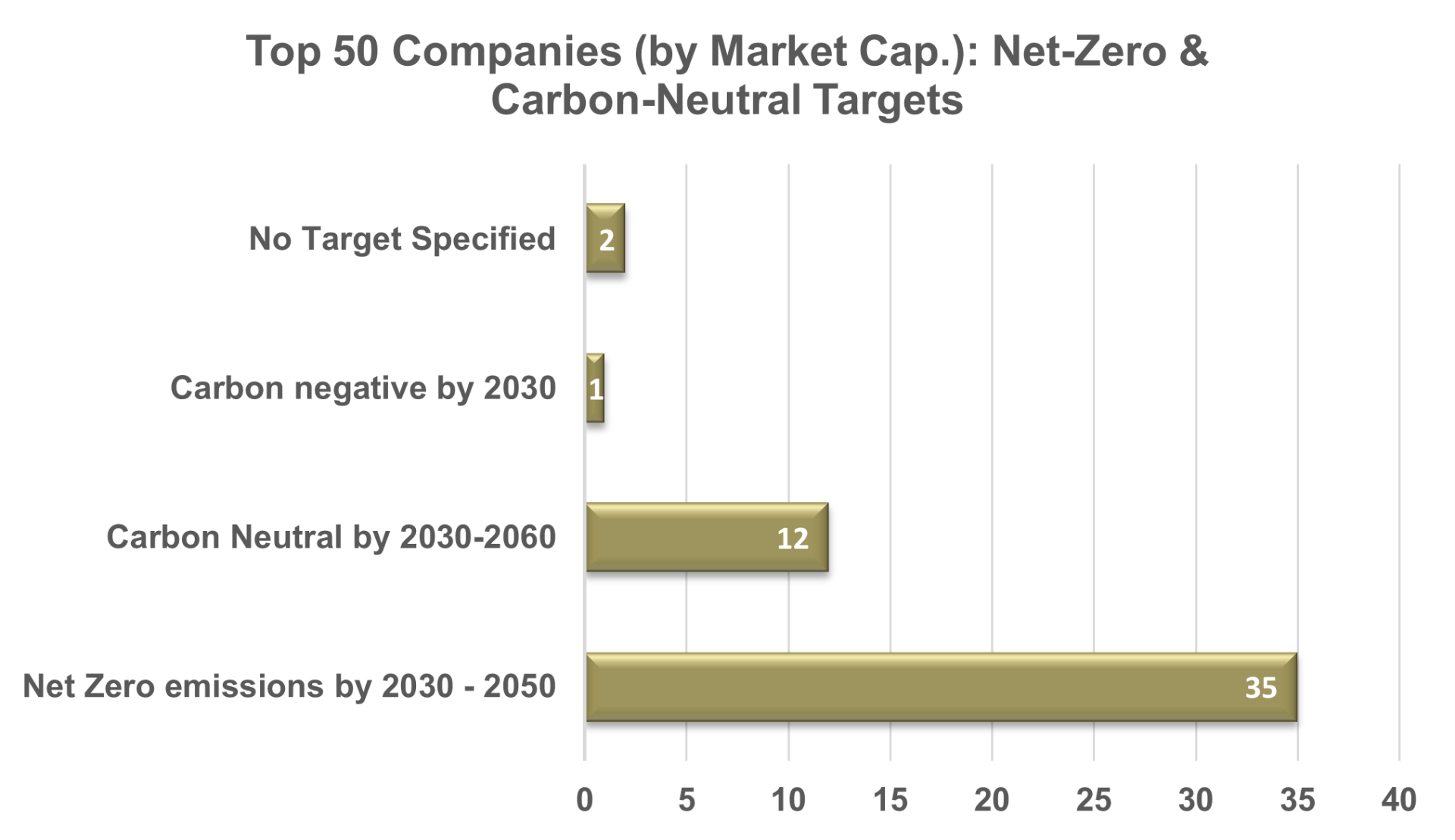

Our analysis of sustainability disclosures from Forbes' Top 50 companies by market capitalization reveals how leading companies across various industries—such as Energy, Finance, Technology, Retail, Healthcare, Telecom, and Automotive—are setting ambitious net-zero targets and integrating carbon credits into their environmental strategies. The graph below illustrates the distribution of these net-zero targets among the top global companies.

Carbon offsetting by Top 50 companies

52% of the companies are actively procuring carbon credits as part of their efforts to reduce carbon emissions. Below is a sector-wise breakdown of companies.

| S.no. | Name of the company | Sector |

|---|---|---|

1 | JPMorgan Chase & Co. | Finance |

2 | Industrial & Commercial Bank of China Ltd. (ICBC) | Finance |

3 | Bank of America Corporation | Finance |

4 | China Construction Bank Corporation | Finance |

5 | Agricultural Bank of China Limited | Finance |

6 | Bank of China Limited | Finance |

7 | HSBC Holdings plc | Finance |

8 | Wells Fargo & Company | Finance |

9 | The Goldman Sachs Group, Inc. | Finance |

10 | Morgan Stanley | Finance |

11 | Royal Bank of Canada (RBC) | Finance |

12 | Citigroup Inc. | Finance |

13 | Ping An Insurance (Group) Company of China, Ltd. | Finance |

14 | Allianz SE | Finance |

15 | BNP Paribas SA | Finance |

16 | China Merchants Bank Co., Ltd. | Finance |

17 | UBS Group AG | Finance |

18 | Mitsubishi UFJ Financial | Finance |

19 | TD Bank Group | Finance |

20 | Santander Bank | Finance |

21 | Verizon Communications Inc. | Finance |

22 | Saudi Arabian Oil Company (Saudi Aramco) | Energy |

23 | Exxon Mobil Corporation | Energy |

24 | Shell plc | Energy |

25 | PetroChina Company Limited | Energy |

26 | Chevron Corporation | Energy |

27 | TotalEnergies SE | Energy |

28 | China Petroleum & Chemical Corporation (Sinopec Group) | Energy |

29 | BP p.l.c. | Energy |

30 | Reliance Industries Limited | Energy |

31 | China Mobile Limited | Telecom |

32 | AT&T Inc. | Telecom |

33 | Comcast Corporation | Telecom |

34 | Amazon.com, Inc. | Retail |

35 | Walmart Inc. | Retail |

36 | Microsoft Corporation | Technology |

37 | Alphabet Inc. | Technology |

38 | Apple Inc. | Technology |

39 | Samsung Electronics Co., Ltd. | Technology |

40 | Meta Platforms, Inc. | Technology |

41 | Tencent Holdings Limited | Technology |

42 | Alibaba Group Holding Limited | Technology |

43 | Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) | Technology |

44 | UnitedHealth Group Incorporated | Healthcare |

45 | Johnson & Johnson | Healthcare |

46 | LVMH Moët Hennessy Louis Vuitton SE | Luxury Goods |

47 | Toyota Motor Corporation | Automotive |

48 | Volkswagen AG | Automotive |

49 | Nestlé | Food |

50 | Berkshire Hathaway Inc. | Conglomerate (Finance / Energy / Insurance) |

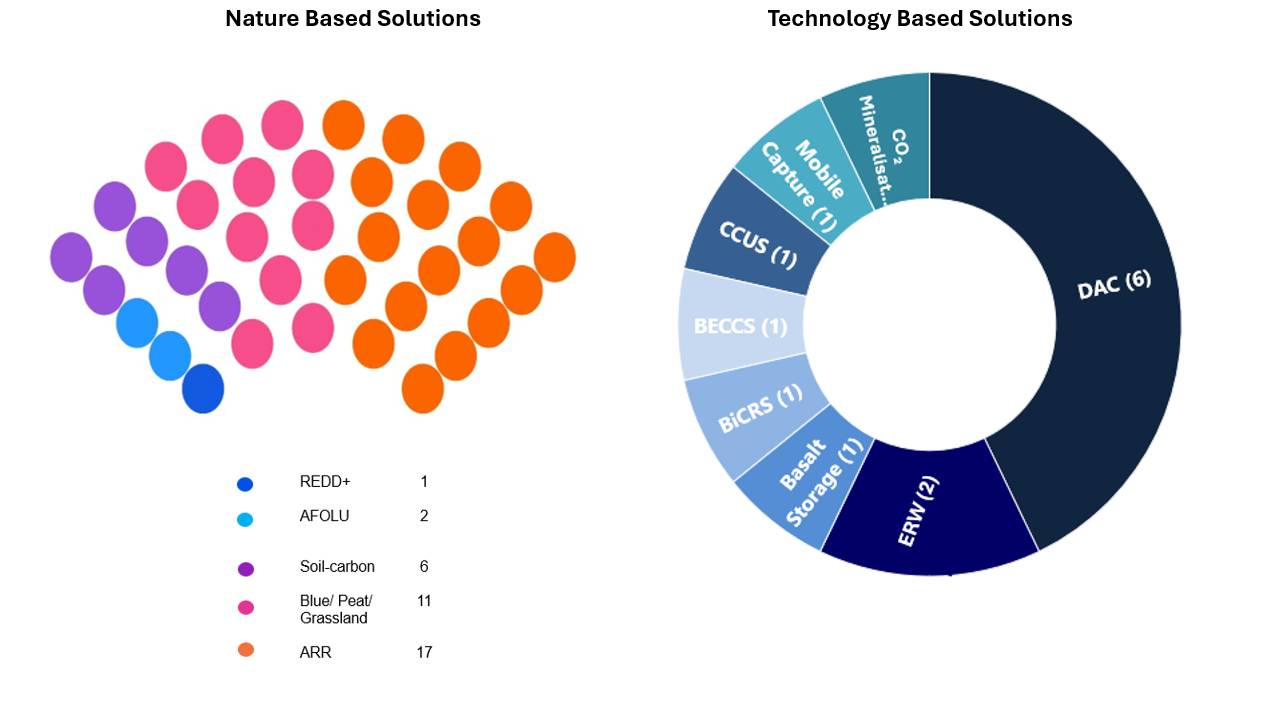

Procurement has been categorised in two types: Nature Based Solutions and Technology Based Solutions. NBS projects include initiatives such as Afforestation, Reforestation, and Revegetation (ARR), mangrove restoration, carbon soil sequestration, and blue carbon, while TBS projects involve technology-driven solutions such as Direct Air Capture (DAC), Bioenergy with Carbon Capture and Storage (BECCS), Biomass Carbon Removal and Storage (BiCRS) and Enhanced Rock Weathering (EWR).

For leading corporates, carbon credits are becoming a strategic tool to accelerate climate goals and underscore long-term environmental commitment.